Globally, new investments amounting to US$7 billion poured into the industry in 2021, more than double the total investment secured by the industry in the last decade, according to a McKinsey & Company analysis. Five AAM companies went public last year with a combined market capitalization of US$10.7 billion, and demand spiked in tandem, signaling increased engagement from a variety of players, as aircraft orders placed totaled 6,850, worth US$26.1 billion.

Activity across the global AAM market is reaching fever pitch. Today, it is no longer a matter of “if” this will happen, but “when.” For the Australian market, AAM could unlock a whole host of applications for logistics, disaster relief, medical evacuations, surveillance and security operations, as well as overland and water transport. The industry started to move beyond renderings and conceptualization, toward real-world deployment that connects users with the technology.

From celluloid dreams to real-world structures — all stakeholders play a critical piece

The next two years will be pivotal for the industry, with the first commercial launch in the U.S. targeted for 2024. Infrastructure developers must put theory to practice, and move ahead with actual operations at least on a small scale if we are ever to meet that target.

This achievement will not be reached alone, but through encouraging a highly collaborative ecosystem which brings together many AAM specialisms. Vertiport infrastructure will form the foundations of this ecosystem, acting as the link between industry, traditional aviation players and the general public.

Vertiport development: it’s more than just marketing

It is easy to get swept up by the allure of stylized artist’s impressions depicting vertiports and the future of travel. However, such “fan art” purely serves marketing objectives, falling short of meeting practical operational needs. Without creating a carefully studied and rigorously tested vertiport network, these isolated nodes will be impractical, potentially unsafe, and effectively preclude the robust drone delivery and passenger flight opportunities that AAM promises.

The requirements of the AAM industry cannot be achieved simply by upgrading existing assets with landing pads. Instead, vertiport design and development requires a team of airport planners, developers, regulatory, airspace and technology experts, and operations personnel — just to name a few.

To accomplish this major shift in the aviation industry, infrastructure developers also need to be well connected and well capitalized. They need to attract capital and support from a diverse range of investors in order to truly move the needle. For instance, Australia-based Goodman Group has taken notice of the transformative potential of AAM, investing in Skyports in March.

“Advanced air mobility has the potential to significantly change the way we transport people and goods,” said Aaron Morgan, Goodman corporate executive. “As a business that provides essential infrastructure to the digital economy, it’s important we understand the technology and are actively involved in shaping the future of transport and logistics.”

Goodman Group’s support for the industry represents a significant development for the entire ecosystem, bringing vast experience and expertise in the industrial property and logistics sectors to AAM players in Australia and globally.

Original equipment manufacturer (OEM) partners, the lifeblood that runs through the veins of vertiport infrastructure, represent another cornerstone for infrastructure developers. AAM companies like Eve Air Mobility, Volocopter, Joby Aviation and Vertical Aerospace, for instance, are working toward gaining certification for their eVTOL aircraft, securing significant aircraft pre-orders. As aircraft developers charge ahead and lead the industry forward, key players like Eve continue to recognize the essential partnership between OEMs and infrastructure developers in truly getting the industry off the ground.

“Eve has been working with key stakeholders in Australia for a number of years,” said Andre Stein, co-CEO of Eve. “We believe the country has the potential to lead the growth of urban air mobility [UAM] worldwide due to industry interest and investment, government support and its world-leading aviation safety record. Creating a safe and sustainable UAM ecosystem demands innovative solutions, including fleet operations, air traffic management, services and support. And when it comes to infrastructure, such as vertiports, partnering with solid players with real operational experience is essential to ensure they will be ready for operation.”

In collaboration with other players in the industry, these OEMs and forward-looking traditional aviation players have consistently led the way in gaining valuable operational experience for these safety critical operations. Infrastructure developers must take their role seriously, and work alongside partners that have demonstrated expertise in on-ground airport operations. This is essential in order to attain expert guidance and gain the necessary experience to develop real-world solutions for AAM deployment.

Timing and thoughtful deployment is everything

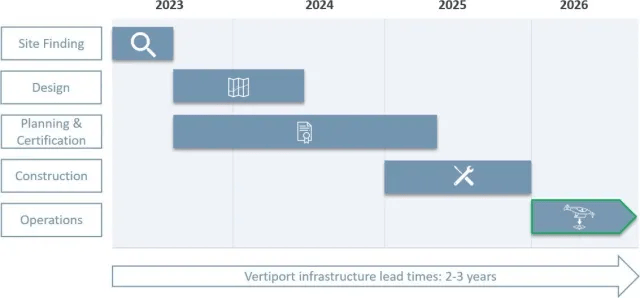

Infrastructure delivery will not happen at the flip of a switch. Developing a thoughtfully-designed network takes time and effort, and will face many challenges. To make real progress, infrastructure developers must be focused on securing sites in strategic locations; developing an airfield design that meets capacity requirements; ensuring adequate services for eVTOL operators, such as electric grid capacity and access and passenger access; and jointly setting regulatory requirements with the relevant authorities.

In short, there will be long lead times for the development of vertiport infrastructure, and real work on the ground must be prioritized to even attain a mid-2020s timeline for initial commercial operations. The industry must collaboratively plan ahead to be ready for deployment when OEMs enter into service, and do away with lofty ambitions devoid of action.

Take Eve, which is backed by giant aerospace OEM Embraer, for instance. The eVTOL company has publicly announced that its timeline for aircraft deliveries will commence in 2026, and has secured 150 orders from Australian operators so far. To meet this target date, infrastructure deployment must begin by 2024, so that the gradual rollout will coincide with vehicle deployment. To meet such a deadline, feasibility studies, engaging with local authorities, and community consultation should already be underway.

Australia is a prime market, landlords are key components of enabling AAM

Australia is set to be one of AAM’s early adopters. Its progressive and supportive regulatory environment has already drawn the attention of various OEMs in the market such as Eve and homegrown AMSL Aero, with a clear AAM vision and roadmap set by the country’s Civil Aviation Safety Authority (CASA). According to a Rolls-Royce and Roland Berger study, by 2030, the Australian market will see at least 120 eVTOL aircraft in operation, reaching US$2.6 billion in service revenue by 2050.

It is critical for the industry and government agencies to have a coordinated approach to launching AAM, with a clear roadmap for commercialization to capture investment from companies. The state of Victoria is leading the way for the rest of the country, having been actively engaged in discourse with the country’s regulators and AAM industry leaders over the past two years. To further foster the long-term growth of the AAM industry in Australia, it signed a memorandum of understanding (MOU) with the federal government in December 2021. Reinforcing Queensland’s position as an AAM frontrunner, the state is home to AAM industry collaboration platform, Greenbird, which aims to coordinate the path forward as an industry body with like-minded partners.

“The Victorian government is proactively preparing for the introduction of advanced air mobility that promises exciting options to expand our transport and supply chain networks,” said Danni Jarrett, CEO of Invest Victoria. “Not only will AAM stimulate economic development and revolutionize a range of industries and critical functions through greater efficiencies, it will also support the transition to more sustainable modes of transport.”

AAM Infrastructure is essential, and real estate owners play a key role in unlocking the landscape for vertiport deployment. It is our view that only a fraction of the buildings that might appear suitable are actually feasible. Proper due diligence is paramount to identifying suitable locations and activating them as take-off and landing sites. Not all rooftops are feasible locations, for example, and could pose safety risks if not assessed and considered carefully. Without considering the air traffic network, airspace constraints and public concerns such as noise, safety and security, this “spray and pray” approach to site selection will be costly and ineffective.

For landlords, being a node on the network can have a positive impact on surrounding communities and real estate value. The runway is closing in on us, and infrastructure developers must immediately commence work with landlords to truly transform existing sites into fully functional vertiports, moving this dream beyond renders and promises and toward a brick-and-mortar reality.